Making money work for you is a great way to achieve financial independence and security. There are many different ways to do this, and the best approach for you will depend on your individual circumstances and goals. However, there are some general tips that can help you get started.

One of the most important things to do is to start saving and investing early. The sooner you start, the more time your money has to grow. Even if you can only save a small amount each month, it will add up over time.

It’s also important to invest in assets that have the potential to grow in value. This could include stocks, bonds, real estate, or even your own business. When you invest in assets, you are essentially putting your money to work for you. Over time, these assets can grow in value, which can provide you with a return on your investment.

Another important tip is to live below your means. This means spending less money than you earn. When you live below your means, you will have more money to save and invest. You can also use this extra money to pay down debt, which can free up even more money in the long run.

Finally, it’s important to make sure that you are financially secure. This means having enough money to cover your basic expenses, such as housing, food, and transportation. It also means having a plan for retirement and for unexpected expenses. By taking these steps, you can make sure that you are financially prepared for whatever life throws your way.

Here are some easy ways to make money work for you:

- Invest in stocks, bonds, and other assets. When you invest in stocks, bonds, and other assets, you are essentially putting your money to work for you. Over time, these assets can grow in value, which can provide you with a return on your investment.

- Start a business. If you have an entrepreneurial spirit, you could start your own business. This can be a great way to make money and achieve financial independence. However, it is important to do your research and plan carefully before starting a business.

- Create a side hustle. A side hustle is a way to make extra money in addition to your regular job. There are many different side hustles that you could pursue, such as freelancing, starting a blog, or selling products online.

- Get a part-time job. If you need to make more money, you could get a part-time job. This can be a great way to supplement your income and save for the future.

- Cut back on expenses. One of the easiest ways to make money work for you is to cut back on your expenses. This could mean cooking at home more often, canceling unnecessary subscriptions, or shopping around for better deals on insurance and other services.

- Get out of debt. If you have debt, such as credit card debt or student loans, make a plan to pay it off as quickly as possible. This will free up more money each month that you can put towards your savings or investments.

- Live below your means. One of the best ways to make money work for you is to live below your means. This means spending less money than you earn. When you live below your means, you will have more money to save and invest.

- Automate your savings. One of the best ways to make sure that you are saving money is to automate your savings. This means setting up a system so that a certain amount of money is automatically transferred from your checking account to your savings account each month.

- Invest in yourself. One of the best investments you can make is in yourself. This could mean taking courses to improve your skills, networking with other professionals, or starting a business. When you invest in yourself, you are increasing your earning potential and your chances of success.

One of the most useful advances brought on by technology is financial management software. A countless number of websites now exist just to improve your financial situation ranging from tools that help you determine solid investments to full-fledged financial management suites.

A great perk to many of these financial services is that they can be used to help you make the right decisions to make your money work for you without having to pay for a personal financial advisor.

Here are a few of the best of these financial tools:

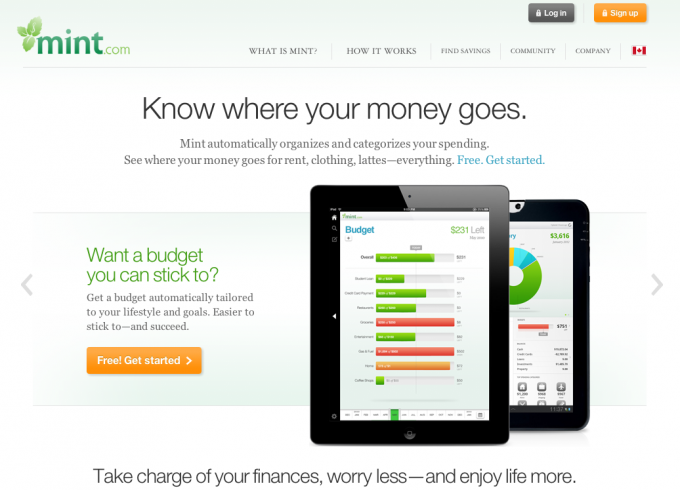

Mint.com

Not much can be said about Mint that hasn’t already. The website is considered one of the standards in personal financial management, and anyone interested in keeping an up-to-date watch on their finances should have the app on their smartphone. With Mint’s services, you can manage multiple bank accounts through the app’s sync feature, set up bill reminders, and even have personal alerts to keep you from breaking your budget. With the app, there really isn’t a good excuse for ever overspending again.

SmartyPig

SmartyPig doesn’t just help you manage your money, it gives you a place to put it. A product of BBVA Compass, the site helps you budget by giving you an actual place to put your savings in the form of a SmartyPig savings account. All you have to do is set a goal and make deposits; SmartyPig tracks your progress for you. SmartyPig is insured by the FDIC and offers a 0.7% APY, so there’s even more incentive to save with them.

ClearCheckbook

ClearCheckbook is a service is very similar to Mint. It allows you to track your bills, project a budget based on recurring expenses, and develop spending reports. It does offer some more in-depth features than Mint, but they cost money, whereas Mint is totally free. However, if you are really interested in getting your finances completely in check, choosing to pay for the additional features of ClearCheckbook, such as budget projections, transactions reports, and future spending estimates, may be well worth it.

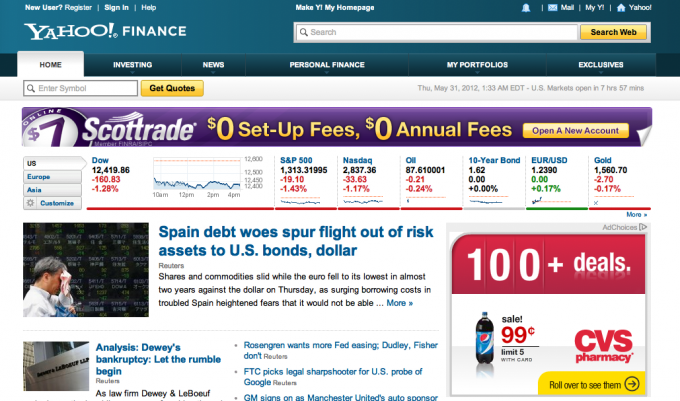

Yahoo Finance

If your other finances are in order and you’re more interested in investment tracking, Yahoo Finance is a great tool to consider. With Yahoo Finance you can track an investment portfolio and get real-time quotes. With the investment features, you can view fluctuations in your portfolio and record any transactions you make. The service does offer an automated bill-paying feature as well, so you can track investments, as well as personal finance, in the same place with Yahoo Finance.

Scottrade

If you want to follow the financial markets, track your portfolios, and buy or sell stocks in one place, then Scottrade is for you. They’re an all-in-one solution for investment management. The company’s low prices on stock transactions has made them a favorite among investors. However, it should be mainly used by those investing in the stock markets. While it does offer some money management features, if you are interested in keeping a monthly budget or tracking your spending, having an app such as Mint or ClearCheckbook would be a good choice in addition to Scottrade.

These tools are just the beginning. Whether you’re trying to obtain save for a vacation or adequately plan for retirement, there are dozens of other free financial tools available online. Take a look at what’s available, and you’ll find that being the master of your finances is easier than you might think.