The world of cryptocurrency is a wild one, and it’s hard to understand what’s happening at any given moment. One second, your tokens are worth less than a cent, and the next they’re worth over $1,000! This was the fate of Ethereum in 2021; from a $730 value in January to over $4,000 in May.

Crypto is a volatile market, but one that’s worth investigating.

And that’s why we’re here—to help you understand the world of cryptocurrency and make informed decisions. Today, we’ll be comparing two of the most popular tokens: Dogecoin vs Bitcoin.

On the surface, they are just a means of transferring money over the internet. But they can make or break your investment portfolio and your financial future. Keep reading to see which currency is the better investment.

What Is Dogecoin?

You can’t really appreciate Dogecoins without knowing its comical history. So let’s start there.

Doge is the name of a meme. It came on the scene in 2013 to refer to the Shiba Inu breed of dog (a Japanese breed). Doge memes comprise a photo of Shiba Inu along with humorous text.

This was the beginning of Dogecoin.

Billy Markus and Jackson Palmer decided to create an altcoin (an alternative cryptocurrency) based on this meme. The goal was to poke fun at Bitcoin, but it gained popularity after being adopted by Reddit users. DOGE was given as a reward for positive content creation and comments on Reddit threads.

Since then, the coin has become one of the most popular digital currencies other than Bitcoin—so popular that it even surpassed Litecoin in terms of market cap. At its peak price, DOGE was $0.7315.

What Is Bitcoin?

Bitcoin is a digital currency that’s not controlled by any single entity. It offers an alternative payment system that would operate free of central control but otherwise be just like traditional currencies.

In its early days, Bitcoin had a poor reputation because of its use on dark websites, like Silk Road and other shady business ventures. But it’s now become the most successful decentralized currency in history. In November 2021 alone, its value skyrocketed up to $68,000!

Dogecoin vs Bitcoin: Which Is the Better Cryptocurrency?

If all decentralized finance functioned the same, it wouldn’t be very exciting. The best way to understand these two coins is by comparing their advantages and disadvantages.

Business Models

Dogecoin’s creators wanted to build a lighthearted and inviting community around their crypto-joke. For them, this was part of its appeal. It’s easier for newbies to understand Dogecoins if there aren’t any secretive millionaires hoarding them away from the rest of us (as is often the case with Bitcoins).

Bitcoin, on the other hand, had a more serious path planned out for it. Its designers wanted their currency to combat banks’ control over economies and global trade by creating an alternative financial system.

Market Cap

When it comes to large-cap cryptocurrencies, there are a few key factors that can help you decide if this is an area where you want to invest.

The market cap is the total value of all the tokens in circulation and their current price based on the supply and demand for each currency. The higher the market cap, the less volatile your investment will be. Generally speaking, these types of coins are safer because established companies are backing them.

Dogecoin has a market cap of about 9 billion dollars, while Bitcoin has a market cap of about $440 billion. If you are looking for more stability in your investment choices, Bitcoin looks like a safer bet than Dogecoin.

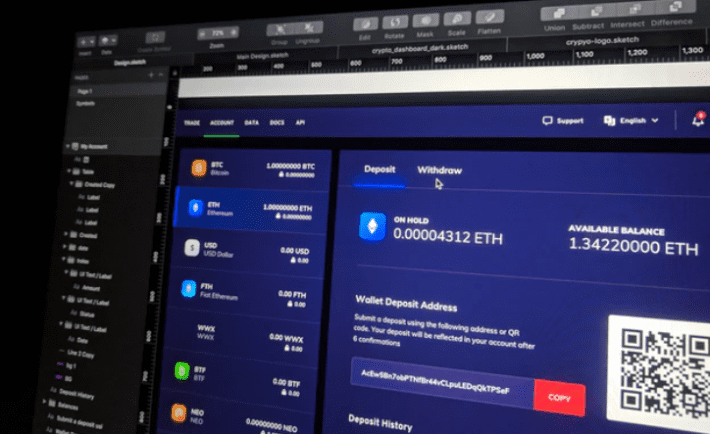

Withdrawals

The cost of withdrawals depends on the cryptocurrency exchange. Coinbase charges a 1% fee, which is higher than what other exchanges charge for withdrawals. For example, Binance charges 0% for withdrawal fees.

Both coins have the same withdrawal methods: direct to your bank or through a cryptocurrency ATM. Find a crypto ATM close to you and you can convert your coins to cash in a single transaction.

Bitcoin vs Dogecoin: Hard Cap

Bitcoin has a hard cap of 21 million coins, while Dogecoin has no limit. In other words, Bitcoin will eventually stop being mined when all 21 million are in circulation, while Dogecoin could keep going forever if its users so choose.

This dynamic makes Dogecoins more attractive as a currency than Bitcoins because they’re less scarce. Theoretically, this would make them easier to use in everyday transactions and perhaps even encourage adoption by smaller businesses who might be wary of accepting cryptocurrency.

From an investment standpoint, however, the reverse is true: because Bitcoin has a finite supply, it is more valuable than Dogecoin. This is partly why Dogecoin developers initially set a hard cap on coins at 100 billion; they wanted people to view it as a currency. However, the developers changed their minds after realizing that people would still see it as an investment.

PoW Consensus Method

PoW is a consensus mechanism used by Bitcoin, Dogecoin, and other cryptocurrencies. You know it as “mining.” This process confirms that transactions on a blockchain are valid and that no double-spending occurs within a transaction block.

PoW also uses an incentive mechanism where miners who solve blocks get rewarded with newly created coins for their efforts. This encourages more people to join in on this activity and keep the network running smoothly. Even you can set up your own mining rig at home with the right tools.

Total Owners

With Bitcoin, the number of total owners is over 180 million. Dogecoin has about 4 million owners at the time this article is written.

As you can see, this is a much smaller number than Bitcoin’s. However, the difference isn’t because of a lack of popularity or interest. It’s simply because Dogecoin has been around for less time than Bitcoin, and therefore hasn’t had as much time to get adopted by users worldwide.

Encryption Type

In the world of cryptocurrencies, there are two main types of encryption: SHA-256 and Scrypt.

SHA-256 is the most common form of cryptographic hashing in Bitcoin and other currencies built on top of Bitcoin’s blockchain. The SHA stands for “secure hash algorithm,” which refers to a mathematical calculation that generates a fixed length output known as a hash function.

Hashes are used to verify data integrity by creating an encoded value that you can easily recognize but doesn’t reveal any information about its contents.

The United States National Security Agency established this framework. The NSA developed this standard for use with sensitive government information because it’s designed to ensure security, even if some parts of your computer get hacked.

Dogecoin’s encryption type is Scrypt. It requires less energy than SHA-256 to mine and is more accessible to home computers. The major difference between the two algorithms is that SHA-256 uses a larger amount of memory than Scrypt, making it less efficient for GPU mining.

Transactions per Second

In terms of transaction speed, Dogecoin is much faster than Bitcoin. Dogecoin’s confirmation times lead to processing around 33 transactions per second. Bitcoin can process 7 TPS on average.

This means that if you’re a major market maker and want your coins to be transferred immediately, then Dogecoin is the way to go.

Block Confirmation Time

One of the most important factors to consider when comparing Dogecoin and Bitcoin is their block confirmation time.

Bitcoin’s average block time is 10 minutes, whereas Dogecoin’s average block time is 1 minute. This means that you can confirm faster transactions on the Dogecoin network than those on the Bitcoin version. You’ll see this as a tremendous advantage for transferring funds and transacting with other users.

Digital tokens are easy to use. However, you can’t enjoy their ease if it takes hours or days for your transaction to go through due to high congestion on a particular blockchain. In this respect, Bitcoin pales in comparison with its younger meme counterpart.

Scalability

Because Dogecoin has no cap on coin production, it’s a more scalable project than Bitcoin. If the demand for Dogecoin increases, it will be able to accommodate that. Bitcoin can’t do the same, but this contributes greatly to its value.

Should You Invest in Dogecoin?

Dogecoin can be a fun addition to your portfolio. If you’re looking to invest in cryptocurrency, however, it’s not the best choice. The project has a lot of potential but lacks the funding and developer support needed to compete effectively with projects like Ethereum or EOS. If you’re interested in Dogecoin, consider buying a few tokens, but don’t expect them to make you a millionaire.

It’s a good way to diversify your holdings and reduce the risk of a major crash in any one project. Having some DOGE on hand will come in handy when you’re looking for a quick profit or just want to show support for the crypto space.

Should You Invest in Bitcoin?

Like any investment, Bitcoin is a risk. If you’re willing to take a chance on it, however, there are some things you should know before investing in Bitcoin:

Risk a Small Amount

If you invest too much money in Bitcoin, you could lose everything when the market crashes. This is the most common mistake people make when investing in Bitcoin. They see it as a get-rich-quick scheme and invest all their money, only to lose it all in a bear market. It’s better to start small and build your portfolio over time rather than risk everything at once.

Be Prepared to Play the Long Game

If you’re looking for quick cash, it might be better to stick with traditional investments like stocks or bonds. Bitcoin is a long-term investment, and you should be prepared to hold on to it for at least a few months before cashing out. If you’re not ready to do that, you should probably avoid Bitcoin altogether.

Future Developments

Bitcoin and Dogecoin are still relatively new, and there are many developments happening in the cryptocurrency world. Here are some of the big ones to watch out for:

Dogecoin

Some analysts predict Dogecoin to grow in value until it hits a price of $0.77 sometime between now and December 31st, 2025. Despite its humorous nature, it’s a coin to watch.

In addition, the open-source token has several upgrades on the way. The most exciting of which is better wallet protection. Also, the Dogecoin Core wallet will feature cheaper transactions and faster confirmation times.

Bitcoin

Bitcoin is also expected to increase in value over the next decade. Despite its price being well below the all-time high, they still expect the token to be worth well over six figures each.

BTC has a dazzling future in 2027. It’s foreseen to start that year at a price of over $200,000 per token. If you were to get in now, that’s almost a 20x return on your investment.

Don’t take these predictions as law—they’re just estimates based on the current market. No one can predict the future with 100% accuracy. One thing is certain; this coin isn’t going anywhere soon.

Invest Wisely

There’s no clear winner in the battle of Dogecoin vs Bitcoin. They’re both powerful forms of currency, but they serve different purposes.

Dogecoin is a neat cryptocurrency that you can use to buy things online or send money to friends and family. As an investment option, however, it’s not as stable as its more respected counterpart, Bitcoin. However, the choice remains yours as to what you decide to invest in.

There are more investment tips in the business section of our blog. Read our other posts for money-making opportunities beyond the crypto space.